Defined Commercial Construction

What’s the essential difference between a recourse and a non-recourse loan? In commercial real-estate both kinds of loans are typical depending on the stage and type of financing. Within brief article we’ll just take a closer evaluate commercial property loans, and specifically the difference between recourse and non-recourse commercial real-estate financial loans, as well as what’s covered by the “bad guy guaranty.”

What’s the essential difference between a recourse and a non-recourse loan? In commercial real-estate both kinds of loans are typical depending on the stage and type of financing. Within brief article we’ll just take a closer evaluate commercial property loans, and specifically the difference between recourse and non-recourse commercial real-estate financial loans, as well as what’s covered by the “bad guy guaranty.”

This is of Recourse and Non-Recourse

First, what perform some terms recourse and non-recourse suggest? This is of a recourse loan is financing where the debtor or guarantors tend to be physically responsible for repaying any outstanding stability regarding the loan, in addition to the security itself. Simply put, if collateral acquiring financing needs to be liquidated it is inadequate to cover just how much owed regarding loan, after that “recourse” makes it possible for the financial institution going after the guarantors physically to pay for this deficiency. Complete recourse financial loans are typical with building along with other reduced term commercial real estate funding, such as for example a mini-perm loan that funds lease up-and stabilization of a secured asset.

A non-recourse loan is defined as financing in which the borrower or guarantors aren't yourself liable for repaying any outstanding balance in the loan. Non-recourse financing is typically found on long term permanent commercial real-estate loans added to a stabilized and performing asset. However, a standard misconception with non-recourse loans is if financing is non-recourse after that a borrower or guarantor cannot be held actually liable in the case of that loan default. It is not always true and there are numerous exemptions frequently covered under what’s known as carve out conditions or even the bad son guaranty.

The Non-Recourse Loan Bad Boy Guaranty

Carve out terms, also known as bad man guaranties, shield the financial institution and enables individual recourse regarding specific activities, such as for example fraudulence. Really, bad guy guaranties tend to be exclusions toward non-recourse standing of financing that initially were intended to avoid the borrower from siphoning money away from a residential property in the months prior to financing standard. This varies by state, but here are a few typical carve out conditions of bad boy clauses incorporated into non-recourse loans:

- Filing for personal bankruptcy

- Fraud or misrepresentation

- Failure to keep up needed insurance

- Failure to pay for residential property fees

- Any ecological indemnification

- Committing an unlawful work

Another common misconception with non-recourse financial loans is that the bad kid guaranty is bound to just these major events or bad acts. Previously this is typically real, but as time passes, the bad child guaranty features gradually broadened to add increasingly more minor provisions, including failure to produce financials to your lender or permit lender inspections associated with the home. These as well as other small carve out conditions may or might not be appropriate or acceptable.

As always, it’s crucial to read through and understand the loan papers and it’s constantly far better ask them to reviewed and negotiated by a competent commercial property attorney.

Recourse vs Non-Recourse Loan Sample

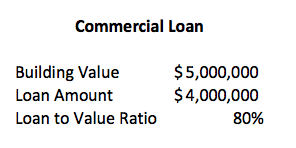

Let’s just take an example to show the difference between recourse and non-recourse financial loans. Assume a borrower has the following loan outstanding for an office building:

Now, suppose the vacancy increases into the building a lot higher than expected and marketplace based local rental rates decrease considerably. Unfortunately, the debtor can’t keep up with their loan payments and ends up defaulting on their loan.