Latest Construction Technology for Buildings

Around 351, 000 multifamily units were started in 2014, up nearly 14per cent over 2013 and more than twice as much 6.6% growth rate for complete housing begins this past year, based on the National Association of Home Builders. In Nashville, multifamily completions hopped about 70per cent, according to commercial property brokerage Marcus & Millichap. Completions in Seattle had been at their greatest level since 2000. Dallas’s 19, 000 completions led the world, with Austin, Tx, and nyc, each with 14, 000, hot on huge D’s heels. Phoenix’s 4, 900 products might finally make a dent in a vacancy rate that in 2014 ended up being only it turned out in seven years.

5 STYLES TO VIEW

1. Urban way of life

2. Affordable luxury

3. Amenities, amenities, amenities

4. Tenant control over technology

5. Green leases

“Condominium demand in Florida, that has been practically nonexistent from 2009 to 2012, is getting, and inventories were largely absorbed, ” says Ted Cava, whom offshore Gilbane’s development and building activities within the Southeast.

At the time of mid-September, multifamily comprised 3.5% of outstanding loans, its highest share since 1992, according to United states Banker mag. About 90per cent of current multifamily construction was leasing apartments. “As the work market continues to recuperate, demand for rental properties continues to run powerful, ” Freddie Mac predicted with its September U.S. financial and housing marketplace Outlook.

Capital is rushing into this sector looking for wealthy comes back on financial investment. Through first 11 months of 2014, Atlanta-based Carroll Organization bought twelve multifamily properties valued at above 0 million. Michael Massie, Executive vice-president for the Picerne Group, a private REIT, says valuations “are removing” in Southern Ca, “and that gives united states confidence to invest in those markets.” Between March and September, Picerne smashed ground on three mid-rise communities with a complete of 676 apartments, such as the first brand new multifamily task becoming approved in Cerritos, Calif., in four years.

Capital is rushing into this sector looking for wealthy comes back on financial investment. Through first 11 months of 2014, Atlanta-based Carroll Organization bought twelve multifamily properties valued at above 0 million. Michael Massie, Executive vice-president for the Picerne Group, a private REIT, says valuations “are removing” in Southern Ca, “and that gives united states confidence to invest in those markets.” Between March and September, Picerne smashed ground on three mid-rise communities with a complete of 676 apartments, such as the first brand new multifamily task becoming approved in Cerritos, Calif., in four years.

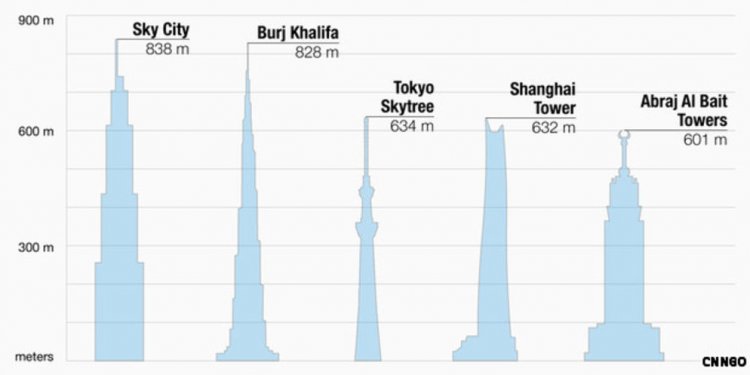

Tom Brink, AIA, LEED AP, a vice-president with RTKL, explains that developers tend to be demanding greater densities from apartment buildings. “Apartments as skyscrapers [are] proving becoming really serious architecture, ” says Brink. He also states there has been a surge in mid-rise areas and communities asking for new level restrictions, and much better usage of metallic versus wood, to boost levels and densities, and to save lots of some time work.

Visions of lofty investment comes back are increasingly being buoyed by lease admiration that struck a 35-year saturated in September, according to apartment marketing research firm Axiometrics. Carl Frinzi, Balfour Beatty Construction’s SVP and Multifamily Housing company commander, tips to a project his firm finished in Mt. Pleasing, S.C., five miles from Charleston, in 2012. The building ended up being sold ahead of the last unit ended up being filled; the yield to your vendor topped 100per cent. The property owner surely could raise rents three times from when the very first tenant signed the rent to if the building was occupied.

Visions of lofty investment comes back are increasingly being buoyed by lease admiration that struck a 35-year saturated in September, according to apartment marketing research firm Axiometrics. Carl Frinzi, Balfour Beatty Construction’s SVP and Multifamily Housing company commander, tips to a project his firm finished in Mt. Pleasing, S.C., five miles from Charleston, in 2012. The building ended up being sold ahead of the last unit ended up being filled; the yield to your vendor topped 100per cent. The property owner surely could raise rents three times from when the very first tenant signed the rent to if the building was occupied.

While building in markets like Chicago, vegas, Raleigh, N.C., and Washington, D.C., has seemed a little frothy recently, the opinion among architects, engineers, construction professionals, and proprietors keeps that multifamily still has runway, simply to maintain family formation—virtually that has arrived from renters within the last couple of years. For-instance, the 4, 000 multifamily units Boston provides yearly still trail its annual 7, 000 brand new family formations, in line with the commercial property franchisor Sperry Van Ness.

Let’s explore five trends that experts consulted by BD+C say are propelling the multifamily market.

Trend # 1: The search for the metropolitan life style

Multifamily products are attracting all adult cohorts, however their real objectives seem to be Millennials and vacant nesters. Stephanie McCleskey, Axiometrics’s VP of analysis, notes that, from 2010 to 2013, 750, 000 brand new renter families were formed whose heads were 55 to 64 years of age.

AvalonBay Communities, an equity REIT, positions its companies to align with these demographic delineations. Its Avalon brand name aims at exactly what Matt Birenbaum, the company’s EVP of business Technique, calls “comfort creatures”––renters by option, mostly inside their 30s, who want high-service, high-amenity living. Its AVA brand interests what Birenbaum calls “young urban socials, ” mainly Millennials, who'll trade room for close-in area and would like to stay near like-minded men and women. Its eaves by Avalon price brand goals older, family-oriented renters who choose the suburbs.