Construction industry forecast

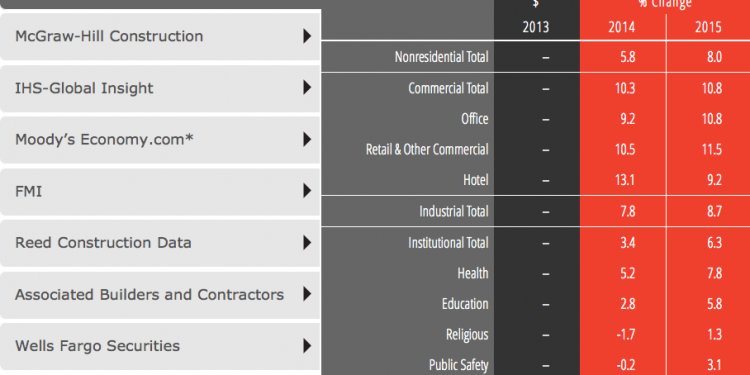

The team forecasts development in nonresidential building spending of 7.4percent the following year, alongside growth in employment and backlog.

"The mid-phase of this recovery is usually the lengthiest part and ultimately offers option to the late phase, whenever economy overheats, ” ABC Chief Economist Anirban Basu stated. "Already, signs of overheating tend to be obvious, especially with regards to promising skills shortages in key business groups such as for example trucking and building."

Basu stated that typical per hour profits across all companies are up only 2% before year, underneath the Federal Reserve's aim of 3.5%. Purchase rates in real estate and technology sections are rocketing greater and capitalization rates continue to be unusually low.

In line with the most recent ABC Construction Confidence Index, total contractor confidence has grown regarding both product sales (67.3 to 69.4) and profit margins (61 to 62.9). While the pace of hiring is not expected to increase quickly during the after that six months, mainly due to the lack of suitably trained skilled workers, the price of the latest hires will continue at a steady rate.

ABC's Construction Backlog Indicator also signals powerful demand. Based on the most recent survey, typical specialist backlog stood at 8.5 months by mid-year 2015, with backlog surging in the western US additionally the hefty industrial group.