Commercial Construction starts

Pr Release

Pr Release

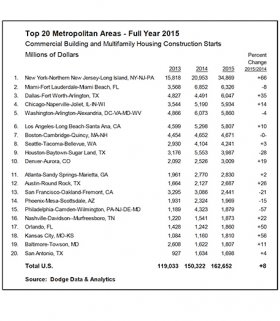

NYC – February 4, 2016 – a ranking associated with the top U.S. metropolitan areas because of the dollar number of construction begins for commercial and multifamily building shows the brand new York City metropolitan area leading the world in 2015, according to Dodge Data & Analytics. A total of $34.9 billion of commercial and multifamily projects in new york metropolitan area achieved groundbreaking during 2015, up 66per cent from last year. For the country in general, commercial and multifamily building in 2015 ended up being reported at $162.7 billion, up 8percent from last year.

Rounding out the most notable five urban centers in 2015 with their portion differ from 2014 had been these – Miami FL, $6.3 billion, down 8per cent; Dallas-Ft. Value TX, $6.0 billion, up 35%; Chicago IL, $5.9 billion, up 14per cent; and Washington DC, $5.9 billion, down 4percent. Urban centers ranked 6 through 10 had been – Los Angeles CA, $5.8 billion, up 10per cent: Boston MA, $4.7 billion, no differ from the last year; Seattle WA, $4.2 billion, up 3%; Houston TX, $4.0 billion, down 28percent; and Denver CO, $3.0 billion, up 19%.

The commercial and multifamily total is comprised of office structures, stores, motels, warehouses, garages and service programs, and multifamily housing. At the nationwide degree, the 8per cent gain when it comes to commercial and multifamily total in 2015 was the result of commercial building holding steady having its improved 2014 quantity while multifamily housing advanced 18%. In 2014, the commercial and multifamily total had hopped 26percent, with razor-sharp increases reported for both commercial building, up 22per cent; and multifamily housing, up 32percent.

“The building begin data do show some deceleration when it comes to commercial building sector at the nationwide degree during 2015, following the substantial gain witnessed during 2014, ” stated Robert A. Murray, main economist for Dodge Data & Analytics. “The data recovery for commercial building has up to now been hesitant, with durations of increased activity frequently accompanied by a pause. On positive side, factors such as usually increasing employment and declining vacancy prices should encourage further growth for workplaces, motels, and warehouses, while store building continues to be much more problematic given the shifting retail landscape. Compared to commercial building, the upward development by multifamily housing is steadier, with 2015 establishing the 6th straight 12 months of double-digit growth, helped in particular by yet another substantial increase reported when it comes to nyc metropolitan location. What sticks out concerning the Nyc metropolitan area in 2015 are the strong building start gains for both commercial building and multifamily housing.”

The 66per cent boost reported in the new york metropolitan area in 2015 ended up being caused by a 95percent hike for commercial building combined with a 52% leap for multifamily housing. Big commercial building jobs that achieved the building begin phase in 2015 were the $2.5 billion 30 Hudson Yards office/retail building, the $1.2 billion 1 Manhattan western office/retail building, while the $840 million 55 Hudson Yards officer tower. In 2015, there have been 43 multifamily jobs appreciated at $100 million or even more that achieved groundbreaking, led because of the $600 million 1800 Park Avenue apartment building, the $587 million 400 W. 61st St. apartment building, the $575 million 15 Hudson Yards apartment building, additionally the $500 million addition towards the Flushing Commons task (period 1). The dollar level of multifamily tasks within the New York City metropolitan location comprised an amazing 27percent associated with the nationwide multifamily total in 2015, up from 21percent in 2014 and 16percent during the 2010-2013 duration. Murray noted, “The multifamily marketplace in new york has been lifted for quite a while today by increased demand from international people, and 2015 saw an additional push in year’s very first half as developers worked for jobs started before the Summer 15 expiration of tax bonuses for multifamily tasks underneath the 421-a system. That program ended up being consequently extended through January 15, 2016, and a brand new system was create to cover 2016 through Summer 2019 with this particular crucial supply – multifamily developers and construction work unions should attain an understanding in the prevailing earnings of construction industry workers carrying out focus on 421-a jobs.”

The Miami FL metropolitan location in 2015 revealed construction starts settling right back 8%, with modest reductions both for commercial building, down 11percent; and multifamily housing, down 6%. In 2014, the Miami FL market had surged 92percent, with commercial accumulating 51per cent and multifamily housing soaring 121per cent. Large commercial building projects that reached the construction start stage in 2015 were led because of the $130 million US Express local office building additionally the $43 million Flagler Station III warehouse building. There have been 11 multifamily projects appreciated at $100 million or more that reached groundbreaking in 2015, such as the $357 million Aria from the Bay condominium building, the $230 million One Paraiso condominium building, and the $215 million Paraiso Bayviews condominium building. The dollar level of multifamily projects within the Miami FL metropolitan area in 2015 comprised 5% of national multifamily total, in comparison to 7per cent in 2014.

The Dallas-Ft. Worth TX metropolitan location, rising 35percent in 2015, signed up development for both commercial building, up 44%; and multifamily housing, up 21percent. The main commercial building projects reported as construction starts included the $570 million Facebook data center (stage 1), the $260 million Liberty Mutual Insurance Claims provider Center Campus, as well as the $120 million stores at Clearfork retail complex. Large multifamily tasks included the $170 million success Put apartment building, the $150 million Ascent apartment building, together with $110 million Bleu Ciel at Harwood Village condominium tower.

The 14per cent enhance reported when it comes to Chicago IL metropolitan location in 2015 had been the result of similar gains for commercial building, up 13per cent; and multifamily housing, up 17per cent. Huge commercial building projects that achieved groundbreaking in 2015 included the $500 million North Riverside office tower, the $400 million consolidated rental automobile center at O’Hare airport terminal, additionally the $350 million McCormick Place Marriott Marquis resort. The most important multifamily jobs had been led by the $275 million number 9 Walton condominium building, the $130 million 1001 Southern State St. apartment building, and also the $128 million 833 North Clark Street apartment building.