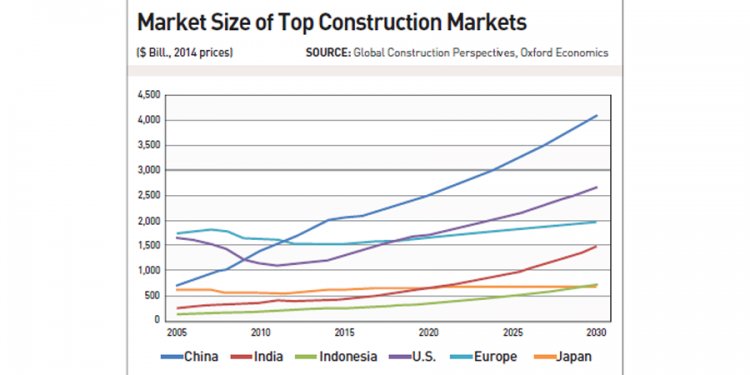

Construction market size

Summary of the European Construction Marketplace

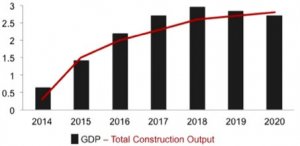

The European building market forecast is without question a complex task for analysts due to the countless different people in the area. However, recent times have observed the European construction market on a path of steady growth. Until 2008, marketplace leads were reasonably bleak, because of the economic downturn. Nevertheless current improvements and an economic recovery recommend a positive perspective for near future. Since 2014, GDP for pretty much all EU nations keeps growing. Hence unsurprising, your future associated with European construction market appears brilliant. Our study experts predict that construction activity increase again from 2015, with development of as much as 3percent yearly.

GDP & Total Construction Output from 2014

European Construction Market Forecast (temporary)

We researched short term growth habits across the European construction marketplace. Our experts predict industry will stabilise in some nations in preparation for lasting future development. In other countries, areas will stay in a stable structure of growth.

2014 CONSTRUCTION OUTPUT percent CHANGE IN GENUINE TERM Billion euro 2014 2015 2016 2017 2018 2019 2020 Germany 285 2, 40 1, 80 0, 20 -0, 40 0, 30 0, 39 0, 48 France 200 -2, 80 -0, 40 1, 80 1, 60 1, 66 2, 13 2, 47 United Kingdom 177 5, 20 5, 10 3, 50 2, 40 3, 12 4, 21 5, 10 Italy 163 -2, 20 1, 10 2, 50 2, 80 3, 72 5, 18 7, 20 Spain 63 -2, 40 1, 80 3, 60 5, 00 6, 50 7, 93 9, 04 Netherlands 60 0, 30 3, 40 3, 50 4, 70 5, 78 7, 98 9, 73 Switzerland 53 0, 80 -0, 70 1, 40 1, 50 1, 97 2, 71 3, 01 Norway 46 2, 10 3, 90 2, 50 2, 90 3, 80 3, 87 5, 04 Poland 44 4, 90 7, 10 6, 20 6, 70 7, 50 8, 78 10, 45 Belgium 39 0, 70 0, 00 1, 50 2, 40 2, 93 3, 40 3, 94 Sweden 34 5, 30 1, 30 1, 10 1, 60 2, 13 2, 60 3, 25 Austria 32 1, 70 1, 00 1, 30 1, 50 1, 91 2, 63 3, 52 Finland 29 -0, 20 1, 50 1, 70 3, 20 4, 10 5, 20 5, 41 Denmark 27 2, 50 2, 90 3, 50 3, 70 4, 26 5, 49 6, 48 Czech Republic 16 1, 00 2, 50 3, 30 4, 00 4, 96 5, 56 7, 67 Portugal 15 -1, 00 2, 50 3, 60 5, 00 6, 55 8, 25 10, 40 Ireland 9 10, 10 9, 00 10, 60 9, 20 9, 29 9, 94 9, 94 Hungary 9 14, 30 5, 10 3, 80 2, 90 3, 45 4, 35 5, 52 Slovak Republic 4 -0, 40 1, 80 2, 70 3, 00 3, 51 4, 00 4, 16 Western Europe 1.232 1, 9 2 2 2 2, 70 2, 97 3, 12 Eastern European Countries 73 5, 5 5, 1 5, 5 5, 5 7, 15 7, 79 9, 98 Euroconstruct Countries 1.305 2, 1 2, 2 2, 2 2, 2 2, 40 2, 52 2, 72Improvement the construction output inside Euroconstruct nations

More we looked at various areas associated with construction business which are anticipated to prosper soon which is likely to have a steady growth structure. 2015 was a critical 12 months when it comes to construction industry in European countries.

2013 2014 2015 2016 2017 2018 2019 2020 Brand New Household -4 0, 1 2, 6 4, 7 3, 7 5, 0 6, 2 7, 6 Brand new Non-residential -5, 2 0, 6

2, 7

2, 1

2, 3

3, 1

4, 1

4, 7

Building R&M

-0, 3

1, 4

1, 6

1, 1

1, 4

1, 8

2, 2

2, 6

Civil Engineering

-4, 2

1, 4

2, 2

2, 6

2, 7

3, 7

4, 4

4, 9

Complete

-2, 7

1

2, 1

2, 2

2, 2

2, 9

3, 6

4, 2

0, 6

2, 7

2, 1

2, 3

3, 1

4, 1

4, 7

Building R&M

-0, 3

1, 4

1, 6

1, 1

1, 4

1, 8

2, 2

2, 6

Civil Engineering

-4, 2

1, 4

2, 2

2, 6

2, 7

3, 7

4, 4

4, 9

Complete

-2, 7

1

2, 1

2, 2

2, 2

2, 9

3, 6

4, 2

Total result development by marketplace segments – per cent growth price in real terms

European Building Marketplace Forecast (lasting)

We think the building marketplace forecast is positive general, anticipating growth in the long run extending beyond 2015. But differences in governmental and financial development suggest it is hard to generalise further. We therefore broken-down the European marketplace into four local and financial groups:

- Western Europe (UK, Austria, Belgium, France, Germany, Ireland, Netherlands and Switzerland)

- Scandinavia (Denmark, Finland, Norway and Sweden)

- South European Countries (Italy, Portugal and Spain)

- Central and Eastern European countries (Czech Republic, Hungary, Poland and Slovak Republic)

Western European Countries

Industry outlook in each of these nations differs based on economic plan and governmental concerns. In Germany, the country aided by the largest economic climate, steady development at 1.2% p.a. is expected until 2017. France has got the poorest forecast 0.1per cent p.a.. Ireland should experience the hightest growth prices at 6percent p.a., a strong sign of economic data recovery in Ireland.

Scandinavian Nations

Regarding the Scandinavian nations, EUROCONSTRUCT (2014) predicts market success across after that 3 years. Even Denmark, the country many afflicted with the financial crisis, is in a position to experience growth in its building market. Further, past marketplace performance inside Scandinavian region contributes to a good basis for future development. Sweden has the strongest development forecast in this region and is anticipated to develop around 5% in 2015 and 4% in 2016.

Southern European Countries

The outlook for Southern European countries is still bleak. Nations like Portugal, Italy and Spain are fighting their economies. Particularly, Spanish businesses whose organizations relate solely to infrastructure being keen to safe jobs overseas. They have had some success, acquiring big tasks from the Middle East. Among the list of significant projects obtained because of the Spanish organizations tend to be agreements to build railway lines in Saudi Arabia (worth €6.73bn), and another underground railroad range in Saudi Arabia (€6.03bn). The method and perspective for this area is go back to security without to spotlight outright development.

Central and Eastern European Countries

The market forecast for Central and Eastern Europe appears bright, as they countries tend to be experiencing financial recovery and going towards habits for development. Our experts predict an improvement price with a minimum of 4per cent in this area, as assets tend to be increasingly produced in transport and energy manufacturing. The railway building marketplace is set-to top €1.5 billion in 2015 [what does this mean]. Poland, given that best player in Central and Eastern Europe, makes up 60percent of construction output in your community.

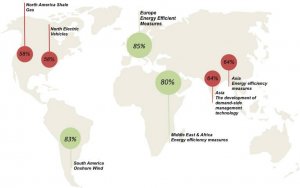

The European Commission’s Action Plan: Building 2020

The near future and perspective the construction industry looks bright and promising, partly because the European Commission wants the construction business to stabilise and grow once more. In 2013, a “Construction 2020” Action Arrange ended up being established because of the goal of making sure the industry becomes more competitive and experiences sustainable development in the quick and long run. The Construction 2020 Action Arrange is a comprehensive program, which describes a technique for “sustainable competitiveness of the construction industry and its businesses” featuring key pillars of competitiveness and effectiveness.