Construction industry Market Size

It's the period of construction economic forecasts, and weekly after Dodge information & Analytics circulated its 2016 Dodge Construction Outlook, the Associated Builders and Contractors hosted a webinar with top economists from significant construction organizations offering their forecasts for the approaching year.

It's the period of construction economic forecasts, and weekly after Dodge information & Analytics circulated its 2016 Dodge Construction Outlook, the Associated Builders and Contractors hosted a webinar with top economists from significant construction organizations offering their forecasts for the approaching year.

Much like Dodge economists, ABC Chief Economist Anirban Basu, United states Institute of Architects Chief Economist Kermit Baker and nationwide Association of Home Builders Chief Economist David Crowe predicted proceeded industry growth in 2016.

ABC Chief Economist Anirban Basu

Anirban Basu

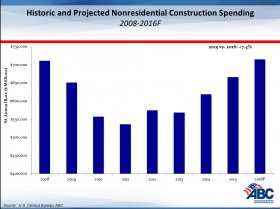

Basu predicted 7.4percent development in nonresidential building investing the following year. He stated the is seeing strong momentum that will carry into 2016. The key issue now for building organizations is driven not by too little need, but by difficulty conference that demand. With a lack of available employees, supply constraints would be the most critical obstacle nonetheless hindering more powerful development, in accordance with Basu.

"The construction business features benefited from increased security stemming from reduced materials rates and greater certainty regarding national cost management and financial policy, although deficiencies in accordingly skilled labor will stay challenging for technicians, " he said.

"The construction business features benefited from increased security stemming from reduced materials rates and greater certainty regarding national cost management and financial policy, although deficiencies in accordingly skilled labor will stay challenging for technicians, " he said.

Basu included that the Federal Reserve's interest decisions has an important affect the construction business and economic climate overall. "The four segments which are operating the economic climate forward — customer investing, auto, residential and nonresidential construction — are mostly focused around low interest, as well as the Federal Reserve understands it. Takeaway these ultra-low interest levels and also the U.S. economy features difficulty."

Basu added: "the following year overall should really be a great 12 months for nonresidential construction spending. One of the leading signs may be the Architectural Billings Index. Architects get busier, which means contractors generally speaking have busier downstream."

Associated designers and Contractors

Associated designers and Contractors

AIA Chief Economist Kermit Baker

Kermit Baker

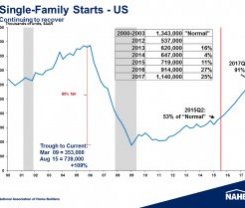

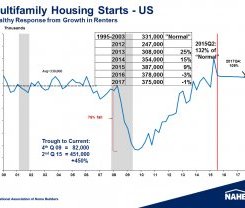

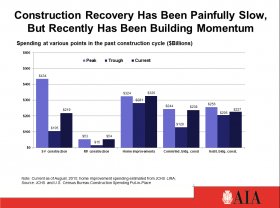

Baker stated he expects considerable development in the single-family sector because of pent-up demand after several years of slowly activity. The multifamily and home-improvement sections have already recovered almost completely after the major downturn throughout the recession and so are today "entering an expansionary phase." Nonresidential building has actually seen regular growth and it is getting nearer to reaching its pre-recession peak.

"Led by tremendous need for energy-efficient rooms, spending on residence improvements is on track to reach an all-time extreme by 12 months's end, " Baker stated. "work and retail sectors are anticipated to lead the commercial real estate market in 2016 with almost double-digit increases in construction investing expected."

Baker pointed to recent growth in existing-home sales and do-it-yourself industry gains as signs the domestic business is just starting to escape "this little lull we have been in for a few quarters."

But Baker cautioned that labor concerns consistently plague the. Building has usually relied on immigrants and pupils from vocational and technical education programs. But with the decrease in immigrant employees and a lack of young people picking technical training, Baker encouraged a to "focus in the key demographics having usually maybe not offered this market, " especially ladies in the workforce.

But with the decrease in immigrant employees and a lack of young people picking technical training, Baker encouraged a to "focus in the key demographics having usually maybe not offered this market, " especially ladies in the workforce.

American Institute of Architects

NAHB Chief Economist David Crowe

David Crowe

Crowe expressed optimism when it comes to residential construction industry in 2016, mainly because of an improving job market. He pointed toward strong correlation between single-family permits work gains. But despite the recent improvements in the U.S. economy, Crowe stated, "Our company isn't rather to in which we need to be. We still have only a little more to attend have full employment."

Crowe stated the offer side of the industry remains dealing with significant obstacles, specifically usage of competent work and accessibility to buildable lots. He included that the work shortage is continuing mainly because building earnings are less competitive than before the recession. "In 1990, the typical domestic employee made 14% over basic wage price. What's distressing now is that proportion is down seriously to 4percent more. The competitive level is not as good as it was. Sadly, meaning one of several methods to the work shortage is to boost wages, " he stated.