Public Construction companies

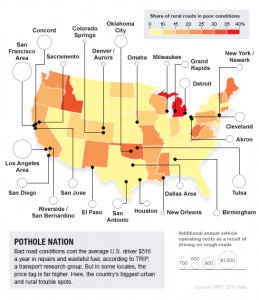

Deteriorating, pothole-strewn highways, collapsing bridges, and corroded, harmful water mains. Catastrophes waiting to happen, all aggravated by bureaucratic bumbling and inaction.

Deteriorating, pothole-strewn highways, collapsing bridges, and corroded, harmful water mains. Catastrophes waiting to happen, all aggravated by bureaucratic bumbling and inaction.

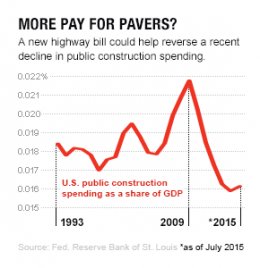

Discussions associated with country’s infrastructure can conjure dystopian images appropriate away from Ayn Rand’s Atlas Shrugged. While there’s some hyperbole for the reason that discussion, there’s no concern that community investment in highways and resources features declined. In dollar terms, general public building spending inside U.S. in 2015 was comparable as with 2007, and as a percentage of GDP, it appears at a two-decade reasonable.

That’s why some company leaders cheered in December when Congress finally passed the QUICK Act, a $305 billion transportation-infrastructure bill. It describes the reason why civic leaders had been urged by the interest delivered to the nation’s water arteries because of the lead-poisoning crisis in Flint, Mich. After a long drought, a public building renaissance might be underway. Which will be crucial that you the healthiness of the broader economic climate, and it surely will develop possibilities for people too—though they may must endeavor into less familiar corners associated with the market to find all of them.

President Obama in the Tappan Zee Bridge in ny. The ongoing $3.9 billion replacement of the connection may be the biggest present U.S. highway project.Photo: Kevin Lamarque—Reuters

The QUICK Act matters because it represents a long-term federal commitment to road-construction investing, with $225 billion apportioned designed for highways over five years. Highway investing had gotten a quick boost during 2009 from stimulation bill passed throughout the depths associated with Great Recession, but Congress hadn’t enacted a significant infrastructure measure since then. States rely on federal money for between 35percent to 100percent of the budgets for significant highway fixes, so they really have now been unable to prepare forward, states Jim Tymon, main running officer on American Association of State Highway and transport Officials. Today, Tymon states, they could accept even more committed jobs.

That said, it really isn’t simple to spend straight this kind of programs. Independently presented contractors and community transportation agencies offer most of materials and work for big infrastructure undertakings. And numerous manufacturers of building gear, new U.S. investing won’t move the needle on profits. Caterpillar, for example, gets simply 8per cent of operating earnings from us construction, and even for the reason that category, an uptick in U.S. highway jobs won’t offset weakness in intercontinental markets therefore the power industry. “Decline in coal and oil costs made all of them into a no-growth company, ” says Morningstar analyst Kwame Webb.

That said, it really isn’t simple to spend straight this kind of programs. Independently presented contractors and community transportation agencies offer most of materials and work for big infrastructure undertakings. And numerous manufacturers of building gear, new U.S. investing won’t move the needle on profits. Caterpillar, for example, gets simply 8per cent of operating earnings from us construction, and even for the reason that category, an uptick in U.S. highway jobs won’t offset weakness in intercontinental markets therefore the power industry. “Decline in coal and oil costs made all of them into a no-growth company, ” says Morningstar analyst Kwame Webb.

For more tangible outcomes, investors are able to turn to companies which make, really, cement. Vulcan products , situated in Birmingham, Ala., offers ready-made asphalt mixtures, and it also’s the largest producer of stone “aggregates” found in cement. Those materials tend to be costly to send lengthy distances, which provides Vulcan a moat against competitors, states Richard Lane, a manager at Broadview Opportunity Fund. Even during Great depression, Lane notes, Vulcan managed to steadily boost prices.

Vulcan has a substantial market share in big says such as for example Ca, Florida, and Texas, where a lot of this new highway investing would be focused. Broadview views income developing 10% to 14per cent annually for at the least the next 2 yrs, up from .4 billion in 2015.

Vulcan has a substantial market share in big says such as for example Ca, Florida, and Texas, where a lot of this new highway investing would be focused. Broadview views income developing 10% to 14per cent annually for at the least the next 2 yrs, up from .4 billion in 2015.

Astec Industries , located in Chattanooga, normally in paving company: It builds the lightweight machines that building teams used to mix tangible and asphalt. Infrastructure jobs account fully for 40per cent of Astec’s roughly $1 billion in yearly revenue, and William Blair analyst Lawrence De Maria states brand new sales should start moving within spring. Product sales of combining devices when you look at the U.S. stand of them costing only 20% of the pre-recession peak. But Astec features attained market share, says Rick Whiting, another supervisor at Broadview, meaning it may get a big revenue boost from even a tiny rebound in sales.

People may purchase stock in the engineering companies that design infrastructure projects, employ the contractors, and handle the paperwork. Here, as with gear manufacturers, many firms tend to be very diversified: like, Jacobs Engineering , situated in Pasadena, gets only 5percent to 10% of revenue from U.S. infrastructure. But UBS analyst Steve Fisher claims Jacobs’s size—it had about billion in product sales in 2015—allows it to handle jobs that smaller organizations can’t handle. Fisher estimates the highway bill, along with an eventual turnaround in energy, helps Jacobs develop profits 20per cent by 2018. Los Angeles–based AECOM , with billion in yearly revenue, could also see a boost from highway bill, but Fisher singles it for its considerable experience in water jobs. That may lift the stock if Flint’s problems cause higher spending on general public normal water infrastructure.

Los Angeles–based AECOM , with billion in yearly revenue, could also see a boost from highway bill, but Fisher singles it for its considerable experience in water jobs. That may lift the stock if Flint’s problems cause higher spending on general public normal water infrastructure.

Employees adjust huge clamps on a rigging system at Tappan Zee connection project.Photo: Courtesy The New York State Thruway Authority

One thing the QUICK Act performedn’t do: boost the 18.4¢-per-gallon gasoline income tax that finances the Highway Trust Fund. Congress featuresn’t raised that income tax since 1993; some transportation analysts believe it's going to turn instead to charging you tolls on national highways to greatly help fund its share of future building jobs. One provision within the highway bill promotes three says to run toll-collection test tasks on federal interstates. On the list of couple of community businesses that operate tolling functions into the U.S., Transurban Group is best poised to capitalize. The Australian organization manages a tolled section of I-95 near Washington, D.C., and might possess inside lane to fully capture much more business if federal tolling gets to be more common. That’s a huge “if, ” but investors can benefit from Transurban’s 4.6percent dividend as they wait.

For more on shares, watch this Fortune video clip:

Transurban is the biggest holding of Russell worldwide Infrastructure, a shared investment whoever holdings are split around 60/40 between foreign and U.S. shares. The fund’s other shares feature another toll-road company (Spain’s Abertis Infraestructuras ), railroads (including Union Pacific and CSX ), and utility companies—along with pipeline operators like Kinder Morgan and Enbridge , whoever stocks have been outdone straight down by the oil-price slump. The fund’s definition of infrastructure demonstrably stretches far beyond highways and liquid mains, and its own yearly expenses, at 1.47per cent of assets, tend to be above average for an actively managed fund. But also for investors whom think these types of organizations would be the skeleton around which future financial development would be built, the investment signifies a somewhat simple solution to get exposure to a wide range of shares at one time.