Tier 1 Construction companies

But in todayâs economy, there is absolutely no real spot to hide. The share price of some our major Australian construction businesses would signal that they are fully priced and show no great prospects for a leap in shareholder value any time soon. Most are trading around their particular 10-year averages – CSR and Boral are great examples.

But in todayâs economy, there is absolutely no real spot to hide. The share price of some our major Australian construction businesses would signal that they are fully priced and show no great prospects for a leap in shareholder value any time soon. Most are trading around their particular 10-year averages – CSR and Boral are great examples.

Another to see is Lend Lease, among Australiaâs leading construction operations. The companyâs market capitalisation at the conclusion of January in 2010 was AU$7.55 billion. They were ranked 42nd in Australiaâs top 100 organizations, somewhat before Mirvac at AU$7.032 billion and James Hardie at AU$7.132 billion. These were way behind 31st-ranked Stockland at AU9.724 billion, however way before Fletcher Building at AU$4.339 billion, Boral at AU$4.164 billion, and BlueScope Steel at AU$2.639 billion, which presented 98th position amongst our ASX top 100.

Beyond these publicly detailed organizations are a number of huge independently had constructors. They make up the Tier 1 constructors in Australian Continent. One marvels the way they is appreciated and exactly how their share costs could have fared over this period. The big challenge for these organizations all boils down during my view with their value proposition. Whatâs with it with their customers? And whatâs set for shareholders? That's the huge story for 2016.

Like all other businesses, building organizations must demonstrate they usually have viable lasting customer focused value propositions that may translate into quality shareholder earnings. Thereâs already been considerable present shareholder value destruction some openly listed constructors wrestle using their basically undifferentiated choices and product like company models. I liken most of these companies towards James Bond team. Their panels employ a relationship, spend him a package and freshen up a script thatâs slightly used since Ian Fleming first created the imaginary James Bond personality in 1953.

Many vertically incorporated construction enterprise is lend-lease. The company provides an excellent case study. Technically, lend-lease enjoys a prominent marketplace place that it provides large public and personal organisations a reduced level of delivery and exchange threat. These clients spend reasonably limited – perhaps more than they appreciate – but danger is risk. But that danger swap premium doesn't fundamentally lead to shareholder earnings. Lend Lease is really as risk-averse as its clients. The building operations indicate that at the best it achieves reasonable margin returns after passing many risk right down to its consultants and technicians.

Other elements erode recurring construction business margins. Lend Lease is a rather large price operator. Some insiders are resigned to a view your business âonly gets a run on tasks which are strange, unique or perhaps in somehow without typical cost limitations.â Lend-lease connections together a vertically built-in pair of services including building, task development, finance, package packaging and financial investment administration. Controlling these margin things is worthwhile. But construction in Australian Continent isn't that simple.

Other elements erode recurring construction business margins. Lend Lease is a rather large price operator. Some insiders are resigned to a view your business âonly gets a run on tasks which are strange, unique or perhaps in somehow without typical cost limitations.â Lend-lease connections together a vertically built-in pair of services including building, task development, finance, package packaging and financial investment administration. Controlling these margin things is worthwhile. But construction in Australian Continent isn't that simple.

The building business is lucky to truly have the amount of insights that lend-lease shares with their people. This understanding just isn't available along with other Tier 1 contractors and developers, therefore itâs quite tough for lend-lease to benchmark with peers or even to show where they have a measurable competitive benefit. Aided by the pending sale of Laing OâRourkeâs Australian operations, possibly even more ideas into building overall performance benchmarks can become apparent, nevertheless building industry is doggedly dimension resistant.

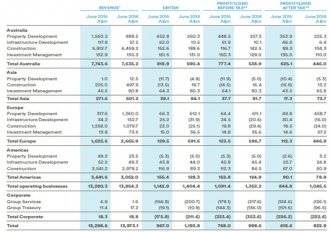

Lend Leaseâs Australian construction business turned over AU$5.912.7 billion and delivered a revenue (EBITDA) of $152.4 million in 2014/15. Thatâs only 2.58 %. But perhaps the value was caught elsewhere in the industry? Lend Leaseâs building operations made up 76 % of this Australian revenue. The organization reported a total group turnover of AU$13, 298.6 billion, delivering an after income tax profit of $618.6 million or 4.65 per cent. Thereâs a bit of mix subsidy happening. The organizationâs 2015/16 development pipeline appears promising, however it will be interesting to see the influence regarding the Aussie building business on group profits.

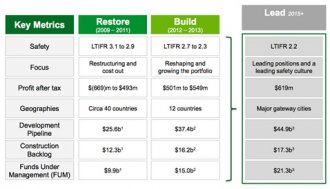

Following 5 years of restructuring the business enterprise, Lend Lease now reports so it has actually completed moving through a Restore, Build and Lead marketplace positioning method. People may expect that development pipeline will provide solid earnings on the after that couple of years.

All constructors publish protection KPIs as an industry performance comparator. Protection is a delivery risk of the best purchase. Lend-lease employs significantly more than 12, 400 people across the world, so are there lots of people to keep safe. Lend Leaseâs staff members deliver about $50, 000 of profit after tax per year. But various other business determining metrics appear to be more opaque and less similar. These could usefully concentrate on the output big photo.

Construction output ought to be a front line problem for Lend Lease. A 20 per cent output improvement throughout the group (with almost all of it via construction) could lift after taxation profit per employee to over $60, 000 per year. Equivalent few workers working more productively may help carry team after taxation revenue as much as $744 million.

Lifting building output in Australian Continent isn't only about taming unlawful union activity. There must be no delusion about the want to very first turn to enhancing off-site management effectiveness and internal business methods. These must result in how projects are better specified, designed, acquired, organised, assessed and how more efficient construction methods tend to be prepared really before workers commencing on-site. With clear strategies to enhance construction output, Lend Lease along with other Tier 1 technicians would after that be placed to place significant efficiency lifting EBA proposals available.

From the face associated with numbers, someone might ask why Lend Lease remains in construction?

Inspite of the businessâs ability to leverage its vertically incorporated enterprize model by utilizing modern building technologies such as for example Building Suggestions Management (BIM) systems and Design for Manufacture and Assembly (DfMA) following the recent announcement of a start-up entry into timber building construction, it is challenging see an immediate correlation with intended output increasing KPIs. Like its construction colleagues, Lend Lease is dimension resistant. There isn't any posted data on which the businessâs tasks are costing, their productivity or their performance against independent bench scars.