Construction trends

Teo Nicolais

Teo Nicolais

by Teo Nicolais. Nicolais is a genuine estate business owner located in Denver. He shows this system owning a home tips as well as classes at Harvard Extension class.

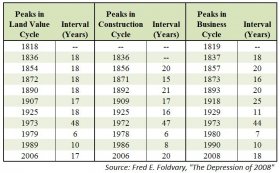

“The next major bust, 18 many years after the 1990 downturn, will likely be around 2008, when there is no significant interruption including a global war.” — Fred E. Foldvary (1997)

The destructive revolution that swept across the United States economic climate in 2008 seemed to catch the planet entirely by surprise. The expression so often always explain it, a “financial tsunami, ” reinforces the most popular belief your catastrophe arose instantly.

In fact the develop towards Great Recession could possibly be demonstrably tracked as well as its time predicted with a wonderful level of precision long before the phrase “collateralized financial obligation responsibility” entered the favorite lexicon.

The real reason behind the crisis is far older, a lot more interesting, and more profitable to understand for everyone thinking about what lies forward.

The four stages of the property pattern

As very early as 1876, Henry George observed the wondering pattern through which areas inexorably move. Their results can be summarized (with the aid of Glenn R. Mueller’s refinements) below:

As very early as 1876, Henry George observed the wondering pattern through which areas inexorably move. Their results can be summarized (with the aid of Glenn R. Mueller’s refinements) below:

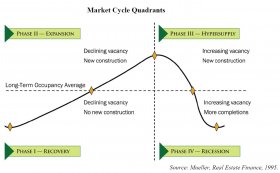

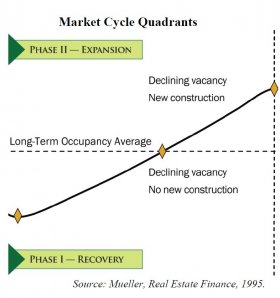

Phase we: data recovery

We all know the attributes of a recession: high jobless; decreased consumption; and diminished company financial investment in buildings, industrial facilities, and devices. The price tag on land, necessary for economic task, is at its lowest point in the cycle.

As population increases therefore does the need for goods and services. This growth is typically hastened by government input by means of reduced rates of interest (the key ingredient for financial investment).

With increasing demand and reduced investment prices, businesses increase their organizations. They hire more folks, develop new factories, and purchase more devices. This expansion adds to the interest in land (buildings) upon which the economic task usually takes destination.

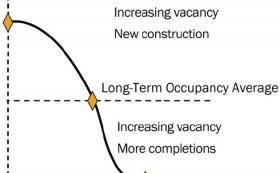

Vacancy across all property asset courses (office, retail, residential, etc.) reduces as organizations utilize previously bare buildings and folks move into formerly vacant houses.

Vacancy across all property asset courses (office, retail, residential, etc.) reduces as organizations utilize previously bare buildings and folks move into formerly vacant houses.

State II: expansion

The transition from recovery to expansion takes place when organizations and folks have obtained up or rented all of the offered structures. Occupancy starts to surpass the long-term average. As unoccupied structures become scarce, landowners raise rents.

Since most real-estate costs tend to be fixed, increased incomes translate virtually dollar-for-dollar into enhanced profits. Enhanced earnings attract brand-new growth of vacant land or redevelopment of current properties.

Fundamental economics informs us that brand new supply will satisfy need and eliminate the upward pressure on rents and land rates properly. But right here’s the perspective: it can take quite a while to incorporate brand-new stock into the real estate market as soon as it’s needed.

Market researches should be undertaken. Land sales needs to be negotiated. Zoning and allowing must be acquired. Funding for task needs to be discovered (no easy feat appearing out of a recession). Just then does brand-new construction begin. Therefore the construction it self takes a number of years (two to 5 years the typical development).

By the time important amounts of inventory begin to come on the web, the overall financial growth has been under way—without the main benefit of brand-new supply—for five to seven many years. During all of that time, occupancy prices and rents being increasing.

In fact, the cycle reaches a place where rents aren't simply going up—they are going up quicker and quicker (rent growth is accelerating). Investors build this trend within their forecasts. And then we reach that important part of the true property cycle in which, as William Newman documented dating back 1935, the price tag on land begins to mirror perhaps not the current market circumstances but alternatively the anticipated lease development in the future.